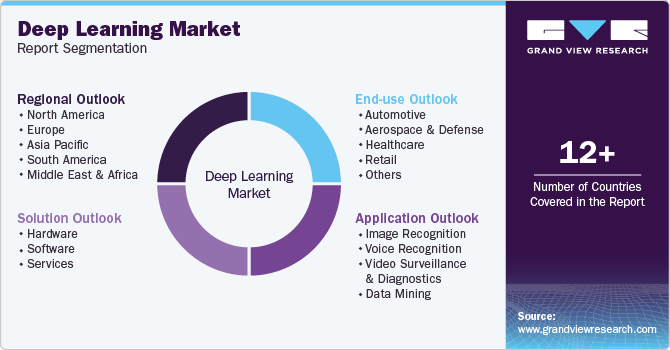

Deep Learning Market Size, Share & Trends Analysis Report By Solution, By Application (Image Recognition, Voice Recognition, Video Surveillance & Diagnostics, Data Mining), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-466-6

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Deep Learning Market Size & Trends

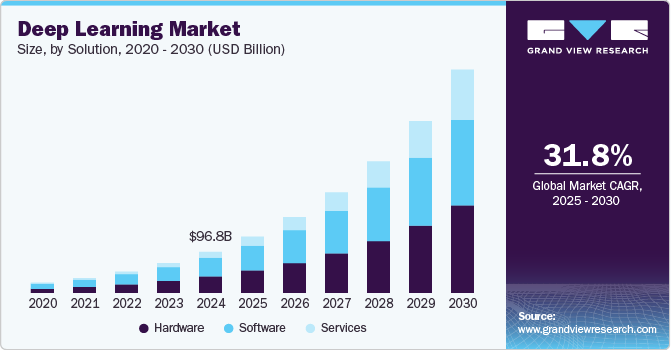

The global deep learning market size was estimated at USD 96.8 billion in 2024 and is expected to grow at a CAGR exceeding 31.8% from 2025 to 2030. Deep learning is gaining prominence because of the advancements in data center capabilities, high computing power, and the ability to perform tasks without human interactions. Moreover, the rapid adoption of cloud-based technology across several industries is fueling the growth of the deep learning industry.

In January 2025, Google AI Research introduced "Titans," a new machine learning architecture designed to address the limitations of existing models, particularly in handling long-term dependencies and large context windows. Titans combine short-term and long-term memory systems, enabling models to efficiently process sequences exceeding 2 million tokens. This architecture separates memory components to control computational costs, allowing models to find and store critical information during inference. By enhancing memory capabilities, Titans aims to improve performance in tasks such as language modeling and genomics, potentially transforming industries like healthcare and finance through faster, more accurate data analysis.

Deep learning algorithms perform several repetitive and routine tasks more efficiently within a shorter time than human beings. In addition to it, the quality of the work is maintained and provides accurate insights. Thus, implementing deep learning in the organization can save time and money, which eventually frees up the employees to perform creative tasks that need human involvement. Therefore, deep learning is considered a disruptive technology across several end use industries, uplifting the demand for technology during the forecast period.

Deep learning technology has grown due to recent developments in neural network architecture and training algorithms, graphics processing units (GPU), and the availability of a significant amount of data across sectors. The increasing adoption of robots, IoT, cybersecurity applications, industrial automation, and machine vision technology led to a large volume of data. This data can serve as a training module in deep learning algorithms, which help diagnose and test purposes. Algorithms of deep learning learn from past experiences and create a consolidated data environment. The more data there is, the more accurate the results will be, and the data will be managed consistently.

Deep learning finds its application in machine translation, chatbots, and service bots. A trained Deep Neural Network (DNN) translates the sentence or a word without using a large database. DNNs provide more accurate and better results than conventional machine translation approaches, which improves system performance.

Solution Insights

The software segment led the deep learning industry and accounted for a revenue share of 46.64% in 2024. The number of software tools for developers has grown significantly over the last few years. As a result, the companies are developing deep learning frameworks through a high level of programming, powerful tools, and libraries that will help design, train, and validate deep neural networks. Moreover, ONNX architecture, machine comprehension, and edge intelligence further enhance the deep learning experience across industries.

The hardware segment is accounted to grow at a significant CAGR of 41.5% over the forecast period. Various startups and established companies focus on new hardware innovations to support efficient deep learning processing. Wave Computing, Inc., Cerebras Systems Inc., and Mythic are some of the startups working on developing deep learning chipsets and hardware. Investors and big corporate companies are also showing keen interest in these startups, accelerating the growth of deep learning technology. For instance, in July 2018, Xilinx, Inc. acquired DeePhi Technology Co., Ltd., a Beijing-based startup company working to develop neural networks and provide end-to-end applications on deep-learning processor unit (DPU) platforms.

Application Insights

Image recognition held the largest market share of around 43.38% in 2024. Deep learning, particularly through Convolutional Neural Networks (CNNs), has significantly improved image recognition accuracy. CNNs can automatically learn from images, capturing complex patterns and details that traditional algorithms struggle with. This has led to error rates in image classification dropping below 5% in competitive benchmarks like the ImageNet Challenge. Moreover, major players are continuously offering deep learning technologies in various industries to fuel market expansion. For instance, IBM's image detection tools utilize deep learning to refine diagnostic processes in healthcare and improve visual search capabilities in e-commerce. Their focus on industry-specific applications demonstrates the versatility of AI-driven image recognition solutions3.

The data mining applications are expected to grow at the fastest CAGR of over 37% during the forecast period. The integration of data mining within deep learning is witnessing significant growth, driven by advancements in technology and increasing data volumes across various industries. Additionally, the increasing volume of data generated from IoT devices and other sources necessitates sophisticated data mining techniques to extract actionable insights, further propelling the demand for deep learning technologies. Major players in the industry, like Google Inc., have been actively developing deep learning frameworks that facilitate easier integration of data mining techniques into business operations. Their research into self-supervised learning models aims to improve how organizations can utilize unlabeled data for insights.

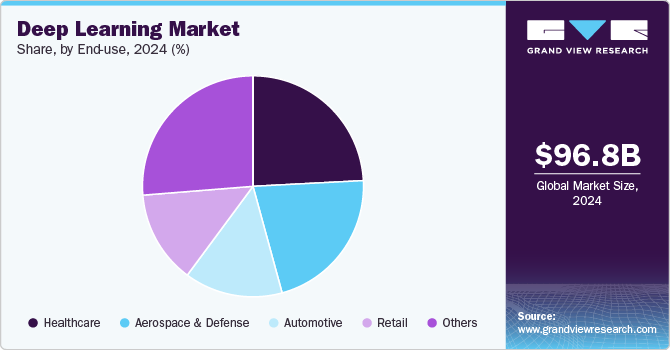

End-use Insights

The automotive end use segment led the deep learning market with the largest revenue share in 2024. The autonomous vehicle is a revolutionary technology that requires a massive amount of computation power. A Deep Neural Network (DNN) rapidly helps the autonomous vehicle perform various tasks without human interference. The autonomous vehicle is expected to gain momentum in the forecast period, and thus various startups and large companies are working on its development. Google Inc., Uber Technologies, Inc., and Tesla, Inc. are some prominent companies showing their capabilities in developing autonomous vehicles.

The healthcare segment is expected to witness significant growth over the forecast period. Digital transformation in the healthcare industry is expected to continue for the next few years, providing an opportunity for innovative technologies such as AI, deep learning, and data analytics to intervene in the industry. Deep learning can be used in predictive analytics, such as early detection of diseases, identifying clinical risk and its drivers, and predicting future hospitalization. Moreover, several government initiatives to integrate AI and deep learning in healthcare are expected to drive the market over the forecast period. Currently, NITI Aayog in India is working on implementing DNN models for the early diagnosis and detection of diabetic and cardiac risk. FDA is also working on a regulatory framework to implement AI and machine learning in the healthcare industry.

Regional Insights

North America deep learning market accounted for the highest revenue share of 33.6% in 2024. This growth is driven by increasing adoption across various sectors, particularly healthcare, automotive, and retail, where deep learning enhances data analysis and operational efficiency. The region's dominance is attributed to strong investments in artificial intelligence and a robust technological infrastructure that supports rapid innovation and implementation of deep learning solutions.

U.S. Deep Learning Market Trends

The U.S. deep learning market held a dominant position in 2024. This expansion is driven by increasing adoption across various sectors, particularly healthcare, automotive, and retail, where deep learning technologies enhance operational efficiency and decision-making processes. The ongoing digitization across industries further fuels demand, as organizations seek to leverage data-driven insights for competitive advantage. Overall, the deep learning sector is poised for robust growth, supported by advancements in AI applications and a thriving startup ecosystem.

Europe Deep Learning Market Trends

Europe’s deep learning market is prominently growing. The demand for deep learning solutions is being driven by advancements in data analytics, autonomous systems, and smart devices, particularly in industries such as healthcare and cybersecurity. Countries like the UK and Germany are leading this transformation, with substantial government support and a growing acceptance of AI technologies among businesses. Europe's proactive approach to integrating AI into its economy presents numerous opportunities for growth in the deep learning sector.

Asia Pacific deep learning Market Trends

The Asia Pacific deep learning market is anticipated to grow at a significant CAGR from 2025 to 2030. The proliferation of big data analytics and advancements in computing power are also facilitating the adoption of deep learning technologies. Additionally, the integration of deep learning with other technologies like IoT is expected to enhance its application scope, further driving market expansion in the region.

Key Deep Learning Company Insights

The market for deep learning is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Arm is a major technology provider specializing in processor IP, graphics, and security solutions, pivotal in powering next-generation computing. With a focus on deep learning and artificial intelligence, Arm's technologies, such as the Armv9 CPU and Immortalis GPU, are integral to advanced mobile devices, enhancing performance and efficiency in AI applications. Their extensive portfolio includes various CPU architectures like Cortex-A and Ethos, designed to meet diverse performance and power requirements across devices.

-

Intel Corporation is a key player in semiconductor manufacturing, renowned for its innovative microprocessors and integrated technologies that power a wide range of computing devices. The company is heavily invested in deep learning and artificial intelligence, offering advanced solutions such as the Intel Xeon Scalable processors and the Intel Nervana Neural Network Processor (NNP), which are designed to accelerate AI workloads and enhance performance in data centers.

Key Deep Learning Companies:

The following are the leading companies in the deep learning market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- ARM Ltd.

- Clarifai, Inc.

- Entilic

- Google, Inc.

- HyperVerge

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

View a comprehensive list of companies in the Deep Learning Market

Recent Developments

-

In June 2024, Hewlett Packard Enterprise and NVIDIA unveiled NVIDIA AI Computing by HPE, a suite of co-developed AI solutions and integrated go-to-market strategies designed to help enterprises accelerate the adoption of generative AI technologies.

-

In March 2024, Google Cloud has unveiled significant advancements in generative AI aimed at enhancing healthcare and life sciences during the HIMSS24 conference in Orlando, Florida. The new Vertex AI Search for Healthcare enables smarter data search capabilities, allowing clinicians to access relevant information quickly and efficiently, thereby reducing administrative burdens. Additionally, the Healthcare Data Engine (HDE) has been introduced as a consumption-priced managed service, facilitating the creation of interoperable data platforms globally.

-

In January 2025, IBM and Red Hat partnered to enhance hybrid cloud adoption by integrating IBM's Hybrid Cloud Mesh with Red Hat's Service Interconnect. This collaboration aims to simplify application connectivity across diverse cloud environments, enabling businesses to deploy and manage applications with greater flexibility and security. By combining IBM's advanced cloud management capabilities with Red Hat's expertise in open-source solutions, the partnership seeks to provide a unified platform for enterprises to accelerate their digital transformation initiatives.

-

In January 2025, Ndea introduced a novel approach to artificial intelligence by combining deep learning with program synthesis, aiming to develop AI systems capable of learning as efficiently as humans. Co-founded by François Chollet, creator of the Keras framework, and Mike Knoop, co-founder of Zapier, Ndea seeks to overcome the limitations of traditional deep learning models by enabling machines to adapt and innovate beyond specific tasks. This strategy positions Ndea to accelerate scientific progress and contribute significantly to the advancement of artificial general intelligence.

Deep Learning Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 132.3 billion |

|

Revenue forecast in 2030 |

USD 526.7 billion |

|

Growth rate |

CAGR of 31.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Solution, application, end-use, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Advanced Micro Devices, Inc.; ARM Ltd.; Clarifai Inc.; Entilic; Google, Inc.; HyperVerge; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Deep Learning Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global deep learning market report based on solution, application, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Central Processing Unit (CPU)

-

Graphics Processing Unit (GPU)

-

Field Programmable Gate Array (FPGA)

-

Application-Specific Integration Circuit (ASIC)

-

-

Software

-

Services

-

Installation Services

-

Integration Services

-

Maintenance & Support Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Image Recognition

-

Voice Recognition

-

Video Surveillance & Diagnostics

-

Data Mining

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global deep learning market size was valued at USD 96.8 billion in 2024 and is expected to reach USD 132.3 billion in 2025.

b. The global deep learning market size is expected to grow at a compound annual growth rate of 31.8% from 2025 to 2030 to reach USD 526.7 billion by 2030.

b. The software segment dominated the deep learning market with a share of 46.6% in 2024. This is attributed to the undergoing radical transformations by transitioning toward Software as a Service (SaaS) powered by deep and machine learning.

b. Some key players operating in the deep learning market include NVIDIA Corporation; Intel Corporation; Google, Inc.; Advanced Micro Devices, Inc.; IBM Corporation; and Microsoft Corporation.

b. Key factors that are driving the deep learning market growth include improvement in deep learning algorithms, a rise in big data analytics, and increasing adoption of artificial intelligence across various end-use verticals.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."